Are Insurers Seeing the Cloud as Cost-Saver or Innovation Driver?

Cloud technology is now among the most disruptive forces in business today, and the insurance sector is no different. Fundamentally, the cloud provides insurers with a tremendous benefit: scalability. Cloud take-up in insurance has taken a familiar trajectory—initial reluctance, gradual adoption, and now a turning point. Although the technology is established, the way insurers think about and utilize it remains to change.

Initially, the C-suite saw cloud adoption in insurance as a cost-reduction strategy—an effective means of streamlining operations and minimizing the need for physical infrastructure. But as insurers have learned to harness the full potential of the cloud, they're beginning to appreciate that its advantages extend well beyond cost savings—there's a great deal more at stake.

The Cloud as a Catalyst for Operational Profitability

Let's get to the numbers, which reveal the real story. A McKinsey analysis last month estimates that by 2030, cloud take-up could add an EBITDA run-rate effect of $70 billion to $110 billion to the insurance industry alone. To put this in perspective, EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) reflects a company's underlying profitability—basically, how well it runs without including outside costs like taxes or maintenance expenses.

This is where the cloud really shines for insurers. It's not merely a tech upgrade—it's an operational efficiency enabler, translating streamlined processes into hard dollars. Indeed, cloud adoption can be responsible for 43-70% of the overall EBITDA impact across all industries, highlighting the tremendous financial payoffs for insurers. This translates to quicker claims processing, more sophisticated data analytics, and enhanced customer interactions—all while reducing costs associated with maintaining legacy infrastructure.

If you consider it, the cloud isn't solely about cost savings for insurers; it's also about driving new revenue. This change is something that can no longer be overlooked in today's competitive market.

Cloud Strategy: Powering the Engine of Insurance Transformation

The advantages of cloud computing has evolved from its initial function of an operational enabler to be the driver of game-changing innovations in the insurance sector. It's the environment where innovative technologies such as AI-driven underwriting, real-time risk modeling, and dynamic price models flourish. What's most interesting is that the cloud flips the definition of scalability on its head—not merely does it run data, it also enables insurers to test, iterate, and roll out pioneering technologies at unparalleled velocity, empowering bold innovations and scalability across world markets.

The insurance market is no longer a few entrenched, century-old players. It is now transformed by collaborations between incumbent insurers and insurtech companies, and the advantages of cloud computing is right at. It's no longer simply a matter of underpinning IT infrastructure; it's now a primary driver of mass disruption in the industry.

Global Cloud Computing Market for SaaS and PaaS

These are just a few exemplary ways cloud strategies are driving innovation:

Driving Agility in an Era of Rapid Change

Agility is the signature of competitiveness in the insurance sector. Gone are the times when slow, laborious processes, typified by protracted policy updates, hardware reliance, and convoluted data migrations, hold sway. In their place are historic speed and flexibility with cloud technology.

For instance, American Family Insurance's cloud collaboration with Amazon Web Services (AWS) in 2022 enhanced its cloud migration, allowing the business to create and release new insurance products, including usage-based insurance (UBI) programs, more rapidly. This strategic decision enabled American Family to innovate more rapidly and advance its digital strength.

Additionally, the scalability of the cloud enables insurers to pilot and deploy solutions at a national or international level without the enormous initial costs that used to accompany international expansion.

Cloud Adoption: Facilitating Global Scalability for High-Value Products

Global scalability is now a reality for insurers as well as tech firms. Cloud technology gives insurers the infrastructure they need to effortlessly expand their offerings across borders.

Consider Chubb as an illustration. Chubb leveraged a cloud-native platform to extend its cyber insurance products worldwide. Through processing massive volumes of localized regulatory data in real-time, Chubb was able to roll out continent-specific cyber policies on several continents without much complexity. This kind of scalability at the global level has helped make Chubb the forerunner in handling emerging threats of today's digital-first economy.

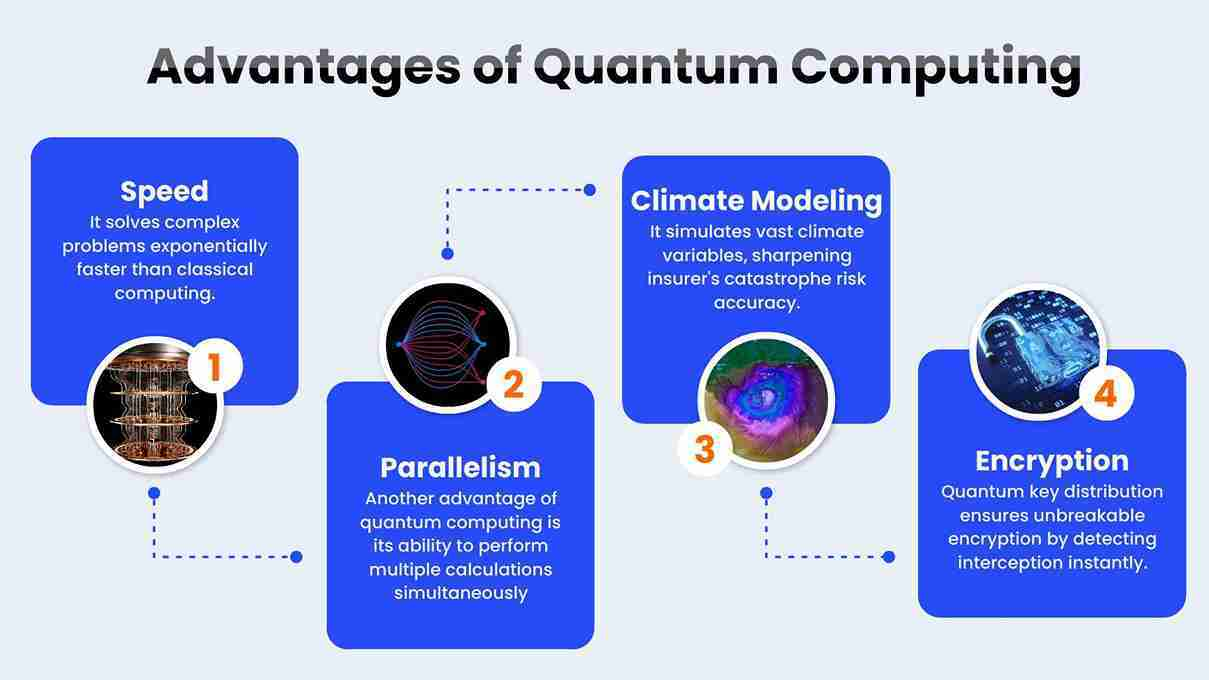

Quantum Computing in Insurance: The Next Innovation Frontier

Another important advantages of cloud computing is that it is helping prepare insurers for the quantum computing age. Forward-thinking insurers are looking at quantum-ready environments, made available by cloud platforms, where they can pilot quantum-safe encryption algorithms. Beyond the security advantage, quantum computing has revolutionary potential for addressing knotty problems in insurance, including portfolio optimization, risk modeling, and fraud detection, in a manner that traditional computers simply can't.

What is Quantum Computing?

Quantum computing is an advance in processing power, employing quantum bits (qubits) rather than binary bits. Due to quantum effects such as superposition (where qubits can be both 1 and 0 simultaneously) and entanglement (where qubits are connected irrespective of distance), quantum computers can process enormous amounts of data at the same time. This implies that they can solve problems that would take conventional computers years or even centuries to solve.

Why Quantum Computing Will Fuel Innovation in Insurance

Quantum computing will transform insurance by allowing for quicker, more precise solutions for intricate processes:

Quicker Risk Modeling and Pricing: Conventional risk evaluations are based on complex models that demand enormous computational power. Quantum computers are able to handle millions of variables and scenarios simultaneously, making it possible to model risks in real-time, price policies more accurately, and deliver tailored policies.

Optimized Portfolio Management: Quantum computing can maximize investment portfolios for insurers, who tend to rely on managing large portfolios. Quantum systems can analyze optimal investment options rapidly and reduce risk, enabling insurers to achieve maximum returns while maintaining financial stability.

Scale Fraud Detection: With fraud running into billions each year in the industry, quantum computing presents a revolutionizing factor by processing large

{

"@context": "https://schema.org",

"@type": "BlogPosting",

"headline": "Are Insurers Seeing the Cloud as Cost-Saver or Innovation Driver?",

"description": "<p style="text-align: justify;"><span class="Editor_t__not_edited_long__JuNNx">Cloud technology&nbsp;</span><span...",

"image": "https://storage.googleapis.com/myliveroomfiles/uploads/photos/2025/04/mylivepics_bfa7b2bf8f15e7f9e4b18ce816afdae9.png",

"author": {

"@type": "Person",

"name": "Barbara Holmes",

"url": "https://myliveroom.com/BarbaraS"

},

"publisher": {

"@type": "Organization",

"name": "MyLiveRoom",

"url": "https://myliveroom.com"

},

"datePublished": "2025-04-05 06:27:44",

"dateModified": "2025-04-05 06:27:44",

"mainEntityOfPage": {

"@type": "WebPage",

"@id": "https://myliveroom.com/blogs/4625/Are-Insurers-Seeing-the-Cloud-as-Cost-Saver-or-Innovation"

},

"url": "https://myliveroom.com/blogs/4625/Are-Insurers-Seeing-the-Cloud-as-Cost-Saver-or-Innovation",

"articleSection": "Other",

"keywords": "advantages_of_cloud_computing",

"wordCount": "65535",

"commentCount": "",

"interactionStatistic": [{

"@type": "InteractionCounter",

"interactionType": "https://schema.org/CommentAction",

"userInteractionCount": ""

},

{

"@type": "InteractionCounter",

"interactionType": "https://schema.org/ViewAction",

"userInteractionCount": ""

}

]

}

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Juegos

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness

- Social